Contents:

Some of the earliest known paper money dates back to China, where the issuing of paper money became common from about 960 AD. A commodity is a basic item that’s used by almost everyone in a given society. In the past, things such as salt, tea, tobacco, cattle, and seeds were considered commodities and therefore, were once used as money.

Google shared AI knowledge with the world — until ChatGPT caught … – The Washington Post

Google shared AI knowledge with the world — until ChatGPT caught ….

Posted: Thu, 04 May 2023 14:00:00 GMT [source]

In the United States, the Gold Standard Act was officialy enacted in 1900, which helped lead to the establishment of a central bank. Consider that today, there are more than 70 billion pound’s worth of notes in circulation – around twice as much as there was a decade ago. Clearly, people still want and need to be able to pay for things with banknotes and will continue to do so for some time yet. It is easy for us in the UK, who have easy access to contactless technology and other ways of paying, to think that paper money is on the way out – but many people around the world rely on paper money to buy things. Released as open-source software in 2009, Bitcoin is a cryptocurrency that was invented by an anonymous person who used the name Satoshi Nakamoto. Bitcoins are digital assets that serve as the reward for a process known as mining and can be exchanged for other currencies, products, and services.

The shift to paper money in Europe increased the amount of international trade that could occur. Banks and the ruling classes started buying currencies from other nations and created the first currency market. The stability of a particular monarchy or government affected the value of the country’s currency, and thus, that country’s ability to trade on an increasingly international currency market. It helps communicate the price of goods and provides individuals with a way to store their wealth.

The Future: Electronic Money

The main purpose of these bills nevertheless was, that traveling with cash was particularly dangerous at the time. A deposit could be made with a banker in one town, in turn a bill of exchange was handed out, that could be redeemed in another town. It has long been assumed that metals, where available, were favored for use as proto-money over such commodities as cattle, cowry shells, or salt, because metals are at once durable, portable, and easily divisible. The use of gold as proto-money has been traced back to the fourth millennium BC when the Egyptians used gold bars of a set weight as a medium of exchange, as had been done earlier in Mesopotamia with silver bars. A touchstone allows the amount of gold in a sample of an alloy to been estimated.

Since 1980, Credit Card companies are exempt from state usury laws, and so can charge any interest rate they see fit. Outside America, other payment cards became more popular than credit cards, such as France’s Carte Bleue. In 1971, United States President Richard Nixon announced that the US dollar would not be directly convertible to Gold anymore. This measure effectively destroyed the Bretton Woods system by removing one of its key components, in what came to be known as the Nixon shock. Since then, the US dollar, and thus all national currencies, are free-floating currencies.

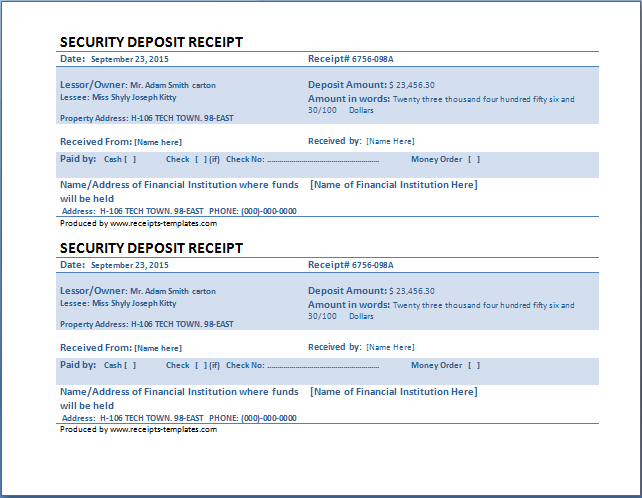

Thereafter merchants preferred to store their gold with the goldsmiths of London, who possessed private vaults, and charged a fee for that service. In exchange for each deposit of precious metal, the goldsmiths issued receipts certifying the quantity and purity of the metal they held as a bailee (i.e., in trust). The goldsmith charged no fee, or even paid interest on these deposits. Since the promissory notes were payable on demand, and the advances to the goldsmith’s customers were repayable over a longer time period, this was an early form of fractional reserve banking. The promissory notes developed into an assignable instrument, which could circulate as a safe and convenient form of money backed by the goldsmith’s promise to pay. Hence goldsmiths could advance loans in the form of gold money, or in the form of promissory notes, or in the form of checking accounts.

Since 1979, Sri Lanka has printed the reverse of its banknotes vertically. Between 1993 and 2013, Brazil has printed banknotes of 5000 and cruzeiros reais and the first Brazilian real series of banknotes has the obverse in traditional horizontal layout, while the reverse is in vertical format. The 2018 Hong Kong dollar banknotes series too has the obverse in traditional horizontal layout, while the reverse is in vertical format. Polymer banknotes were developed to improve durability and prevent counterfeiting through incorporated security features, such as optically variable devices that are extremely difficult to reproduce.

Top 10 Things You Didn’t Know About Money

In any case, who invented paper money among humans certainly pre-dates the use of money. Today individuals, organizations, and governments still use, and often prefer, barter as a form of exchange of goods and services. Still, it is worth considering how paper money came into existence, if only because so many recent reports appear to point to its impending demise.

MARTIN: Remembering rock legend Eddie Van Halen; Willie Nelson … – Herald Zeitung

MARTIN: Remembering rock legend Eddie Van Halen; Willie Nelson ….

Posted: Thu, 04 May 2023 05:00:00 GMT [source]

Since the bulk of the deposits in the temple were of the main staple, barley, a fixed quantity of barley came to be used as a unit of account. Other theorists also note that the status of a particular form of money always depends on the status ascribed to it by humans and by society. For instance, gold may be seen as valuable in one society but not in another or that a bank note is merely a piece of paper until it is agreed that it has monetary value. There are at least two theories of what money is, and these can influence the interpretation of historical and archeological evidence of early monetary systems.

From Bartering to Currency

The traditional date for the invention of more refined paper has long been 105 CE. Cai Lun, the director of the Imperial Workshops at Luoyang, is the one credited with creating paper by using soaked and then pressed plant fibres which were dried in sheets on wooden frames or screens. Cumbersome bamboo or wooden strips and expensive silk had been used for centuries as a surface for writing but, after much endeavour, a lighter and cheaper alternative had finally been found in the form of paper scrolls. At that time, China also started to use coins, they were made of bronze. For a long time, their shape was not round, which changed in the late 3rd century B.C.

Traditionally, paper was invented in the early 2nd century CE, but there is evidence it was much earlier. As a cheaper and more convenient material than bamboo, wood, or silk, paper helped spread literature and literacy but it was used for many other purposes from hats to packaging. The material was made finer over the centuries, was traded across Asia and was used in the first paper money from the early 12th century CE. Objects that occurred rarely in nature and whose circulation could be efficiently controlled emerged as units of value for interactions and exchange. These included shells such as mother-of-pearl that were widely circulated in the Americas and cowry shells that were used in Africa, Europe, Asia and Australia.

This innovation is widely thought to have occurred during the reign (997–1022 CE) of Emperor Zhenzong. By the late 18th and early 19th centuries, paper money had spread to other parts of the world. The bulk of this currency, however, was not money in the traditional sense.

In all, China experienced over 500 years of early paper money, spanning from the ninth through the fifteenth century. Over this period, paper notes grew in production to the point that their value rapidly depreciated and inflation soared. Then beginning in 1455, the use of paper money in China disappeared for several hundred years. This was still many years before paper currency would reappear in Europe, and three centuries before it was considered common.

According to many historians, it was during this time that the kingdom of Lydia (in present-day Turkey) issued the first regulated coins. They appeared during the reign (c. 610–c. 560 BCE) of King Alyattes and were made of electrum, a natural mixture of gold and silver. Crudely shaped like beans, these coins featured the royal symbol, a lion. Alyattes’ son, Croesus (reigned c. 560–546), reformed the kingdom’s currency, introducing silver coins and gold coins. The Mongol Yuan Dynasty, founded by Kublai Khan (1215–1294), issued its own form of paper currency called chao; the Mongols brought it to Persia where it was called djaouor djaw. The Mongols also showed it to Marco Polo (1254–1324) during his 17-year-long stay in Kublai Khan’s court, where he was amazed by the idea of government-backed currency.

- Besides its use for writing and books, paper was used to produce topographical and military maps from the Han dynasty onwards.

- USD is the currency abbreviation for the United States dollar, the official currency of the United States of America.

- Scientists have tracked exchange and trade through the archaeological record, starting in Upper Paleolithic when groups of hunters traded for the best flint weapons and other tools.

- Only with this technique it was possible, at that time, to force the paper into the lines of the engraving and to make suitable banknotes.

More denominations came in, layouts evolved, more languages and details were introduced. These notes came along to be the first official paper notes by a government in India. They came in denominations of Rs 10, Rs 20, Rs 50, Rs 100, and Rs 1,000, with currency details in two languages, and a portrait of the queen.

This meant that the note could be used as currency based on the security of the goldsmith, not the account holder of the goldsmith-banker. The bankers also began issuing a greater value of notes than the total value of their physical reserves in the form of loans, on the assumption that they would not have to redeem all of their issued banknotes at the same time. This was a natural extension of debt-based issuance of split tally sticks used for centuries in places like St. Giles Fair, however done in this way it was able to directly expand the expansion of the supply of circulating money. As these receipts were increasingly used in the money circulation system, depositors began to ask for multiple receipts to be made out in smaller, fixed denominations for use as money.

European explorers and merchants

The use of banknotes issued by private commercial banks as legal tender has gradually been replaced by the issuance of bank notes authorized and controlled by national governments. The Bank of England was granted sole rights to issue banknotes in England after 1694. In the United States, the Federal Reserve Bank was granted similar rights after its establishment in 1913.

With trade renewed along the Silk Road, this simplified cartage considerably. These privately-produced promissory notes were still not true paper currency, however. Following increases in trade, the system of barter, or the exchange of one material for another, was replaced by a system where one particular commodity came to be a common form of payment. In China rolls of silk or gold ingots could be used to pay for any other type of goods. For smaller exchanges metal coinage was used, first in the shape of tools, then in the form of more convenient small coins.

Coins were typically minted by governments and then stamped with an emblem that guaranteed the weight and value of the metal. Sometimes governments would reduce the amount of precious metal in a coin and assert the same face value, this practice is known as debasement. In my own excavation work in 2012, I recovered a 600-year-old Chinese Yongle Tongbao coin at the ancient Kenyan trade port Manda, in the Indian Ocean. Chinese coins were small disks of copper and silver with a hole in the center so they could be worn on a belt.

Christian Nodal, the tattooed mariachi: ‘It became cool to be Mexican’ – EL PAÍS USA

Christian Nodal, the tattooed mariachi: ‘It became cool to be Mexican’.

Posted: Sat, 06 May 2023 01:03:00 GMT [source]

Crane and Company patented banknote paper with embedded silk threads in 1844 and has supplied paper to the United States Treasury since 1879. Banknotes printed on pure silk “paper” include “emergency money” Notgeld issues from a number of German towns in 1923 during a period of fiscal crisis and hyperinflation. Most notoriously, Bielefeld produced a number of silk, leather, velvet, linen and wood issues. These issues were produced primarily for collectors, rather than for circulation. Banknotes printed on cloth include a number of Communist Revolutionary issues in China from areas such as Xinjiang, or Sinkiang, in the United Islamic Republic of East Turkestan in 1933. Emergency money was also printed in 1902 on khaki shirt fabric during the Boer War.

This involves a race between computers to solve complex math problems and thus verify blocks of transactions. It’s estimated that nearly seven trillion attempts may have to be made before a solution is discovered. In the end, the owner of the winning computer gets newly created Bitcoins, and the system is made more secure. The cap for the number of Bitcoins that can be created is 21 million, and more than 17 million have been created so far. The development of computer technology in the second part of the twentieth century allowed money to be represented digitally. By 1990, in the United States, all money transferred between its central bank and commercial banks was in electronic form.

The UK’s central bank, the Bank of England, prints notes which are legal tender in England and Wales; these notes are also usable as money in the rest of the UK . For years, the mode of collecting banknotes was through a handful of mail order dealers who issued price lists and catalogs. In the early 1990s, it became more common for rare notes to be sold at various coin and currency shows via auction. The illustrated catalogs and “event nature” of the auction practice seemed to fuel a sharp rise in overall awareness of paper money in the numismatic community. The emergence of currency third party grading services (similar to services that grade and “slab”, or encapsulate, coins) also may have increased collector and investor interest in notes. Entire advanced collections are often sold at one time, and to this day single auctions can generate millions in gross sales.

- Money doesn’t always have value whether it’s represented by a seashell, a metal coin, a piece of paper, or a string of code mined electronically by a computer.

- Like the loans made by the Egyptian grain banks, this trade credit became a significant source for the creation of new money.

- Consider for example, the sharing of food in some hunter-gatherer societies, where food-sharing is a safeguard against the failure of any individual’s daily foraging.

The outside world, or at least the world west of China, acquired the knowledge of paper manufacturing in the 8th century CE . The trigger was when a group of papermakers were taken prisoner by their Arab victors following the Battle of Talas. Soon Baghdad would become a major producer of paper, and Medieval Europe, too, would eventually produce high-quality paper of its own. Medieval English tally sticks recorded transactions and monetary debts.

Today, eBay has surpassed auctions in terms of highest volume of sales of banknotes. However, rare banknotes still sell for much less than comparable rare coins. This disparity is diminishing as paper money prices continue to rise. A few rare and historical banknotes have sold for more than a million dollars.